An operating margin of 64%; free cash flow of US$8.5bn; return on capital of over 40%. Those are half-year numbers. They come from BHP, easily the best miner in the world, and now the largest dividend-paying business on the planet.

Sometime in this quarter, Woodside will acquire BHP’s Petroleum business. BHP shareholders will receive payment in WPL shares with BHP shareholders set to own around 48% of the combined entity. It seems that BHP shareholders will receive approx. 0.1768 shares in Woodside for every BHP share held. The new shares will be treated as an in specie dividend valued at WPL's closing price the day before the new issue.

The 0.1768-WPL-to-1-BHP-share ratio is not entirely clear yet nor is the date on which a BHP shareholder's entitlement is determined. As the value of the new WPL share is treated as a taxable dividend (plus its stapled franking credit), it would also result in an additional tax bill for anyone whose marginal tax rate is above 30%. As for share price movements, WPL's share price is not expected to move as a result of this issue as it receives value from BHP for the shares issued, whereas BHP's shares would drop as they always do after a dividend payment.

There have also been suggestions that BHP could use its entire franking which includes a US$16 billion franking balance, to offer a special dividend worth $US3.36 per share or an off-market buyback worth US$40bn which would be 11% earnings accretive and worth waiting for.

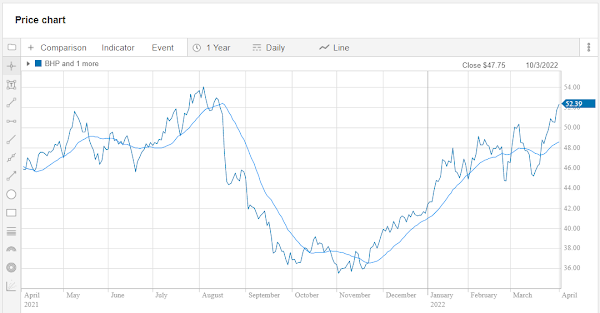

Enthusiasm for BHP is now almost universal, as investors are turning to resources - until commodity prices fall. The time to buy has passed but the time to sell - at around $55 - is getting within striking distance.

P.S. For more on the Woodside/BHP Petroleum merger, click here.