As the iron ore industry ponders its ‘green steel’ future, miners developing high-grade products will gain the support of steelmakers and investors. Hawsons Iron is one of these – an emerging iron ore company that saw its share price jump 18 per cent in April and has experienced a 176 per cent increase last month.

Earlier this week, it was revealed the Australian Government had renewed the major project status (MPS) of the Hawsons Iron project in Broken Hill for another three years. Once up and running, Hawsons Iron will produce a 70 per cent iron (Fe) product known as ‘Hawsons Supergrade’, poised to be one of the highest-grade Fe products on the seaborne market.

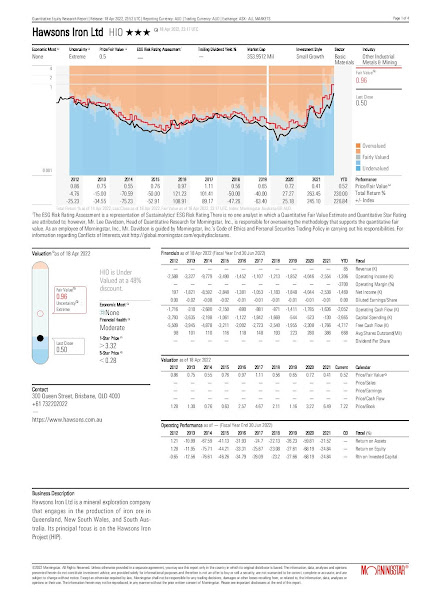

Overcautious, I took only a small position in Hawsons in mid-2021 when it was still trading as Carpentaria Resources. This has paid off, and I have since doubled down on it, and not too soon either, as even Morningstar thinks it is trading at a 48% discount to its fair value.

P.S. This is not a recommendation as I am not allowed to give financial advice. The only financial advice I am allowed to give you is as follows: