Australian resources export revenue reached a new record high of $351 billion in 2021, according to the latest data from the Australian Bureau of Statistics.

The record shows a 21 per cent increase from the previous high set in 2019, with resources contributing 68 per cent of total Australian export revenue.

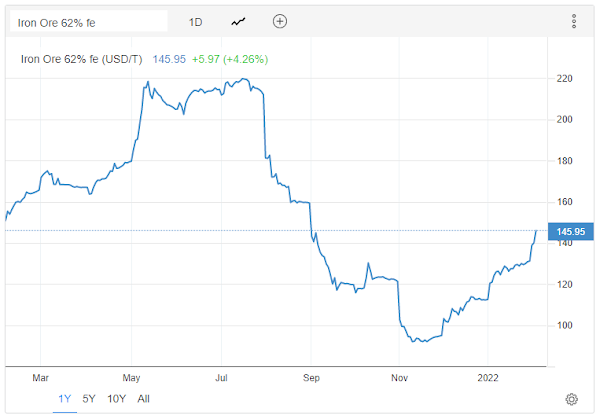

Iron ore was the highest contributing resource with $154.2 billion, up 32 per cent from 2020 to set its own record high.

Coal contributed $62 billion, up 43 per cent from 2020, with aluminium (including alumina and bauxite) adding $13.7 billion, up 15 per cent from 2020.

Copper (metal and concentrates) added $12.1 billion, up 14 per cent from 2020 and a new record high, while gold contributed $25.9 billion.

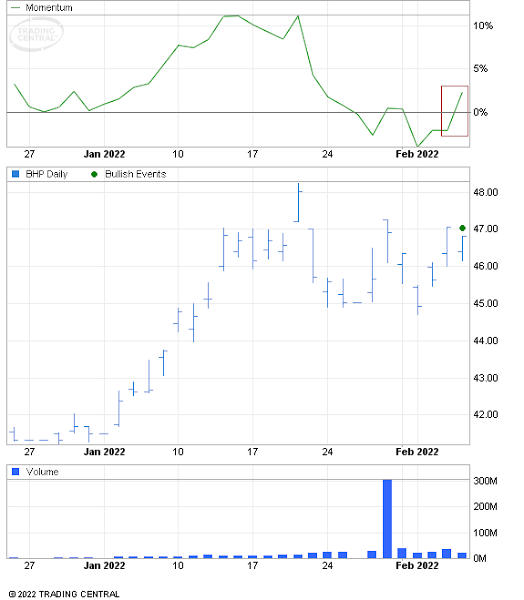

These latest monthly figures show Australia’s resource and energy exports continue to surge in record territory. And so do BHP's profits which are foreshadowed in its resurging share price.

As Trading Central reports, ""A 'Momentum' chart pattern formed on BHP Group Ltd. This bullish signal indicates that the stock price may rise from today's close of $46.81."

It's still a long way from its 52-week-high of $54.55, reached as recently as 4th August 2021 when iron ore topped $200/tonne (which is when I should've sold - but didn't! - because immediately afterwards BHP began to drop and continued to drop until it hit a new 52-week low of $35.56 on 2nd November before climbing back above $40 a month later and, thankfully, having stayed above $40 ever since), but here's hoping!